Since publication of this post, the tracts nominated last month have been so designated by the Department of Treasury. -Ed.

Since publication of this post, the tracts nominated last month have been so designated by the Department of Treasury. -Ed.

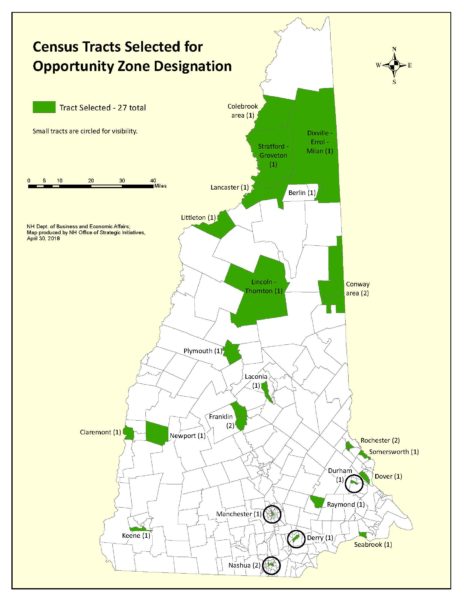

New Hampshire Governor Chris Sununu has nominated 27 low income census tracts of the state to be designated as Opportunity Zones, part of a federal program encouraging economic development and investment in neighborhoods around the country. Governor Sununu made the announcement from Marceau Park in Franklin, one of the areas designated today.

In New Hampshire, the areas nominated include tracts and contiguous tracts, ranging from the Manchester Millyard, downtown Rochester and tracts in the Seacoast, to the White Mountains and the North Country.

“New Hampshire’s resiliency lies in our local communities – they are the backbone of our society and the focal point of cultural activity,” said Governor Chris Sununu. “For far too long, however, some communities have been left behind. While some have thrived in recent years, others are struggling to keep up. Today, we are announcing 27 Opportunity Zones across the state to encourage investments in areas that are often left behind. Opportunity Zones provide tax incentives to investors to reinvest unrealized capital gains into neighborhoods throughout the state. These local neighborhoods deserve an economic boost, and that is what we are going to give them. The goal is simple: to create jobs, to increase wages, and to revitalize communities across the state.”

For more information about the Opportunity Zone nominations, visit our website.

“Our goal was to designate tracts that present the best opportunities for investment and can leverage other state and federal resources. My hope is that once this program is fully deployed, it can serve as catalyst to bringing economic opportunity to New Hampshire communities,” said Taylor Caswell, Commissioner, New Hampshire Business and Economic Affairs.

The program was created by the Tax Cuts and Jobs Act, which provides federal tax incentives to investors in areas designated as an Opportunity Zone and is administered by the U.S. Treasury Department. States were required to designate 25% of the low income census tracts in the state as Opportunity Zones. Investors can defer capital gains on earnings reinvested in the zones and long-term investments maintained for over 10 years do not have to pay additional capital gains taxes on earnings from Opportunity Zone investments.

Final designations are subject to federal confirmation and final rules for the new Opportunity Zone are being developed by the US Treasury.

Communities nominated for federal Opportunity Zones:

- Berlin

- Claremont

- Colebrook, Atkinson and Gilmanton Grant

- Conway/North Conway

- Derry

- Dixville Notch, Columbia, Millsfield, Errol, Dummer, Milan, Cambridge, Success, Erving and Wentworth’s Location, Second College Grant

- Dover

- Durham

- Franklin

- Keene

- Laconia

- Lancaster, Kilkenny

- Lincoln, Easton, Waterville Valley, Livermore

- Littleton

- Manchester

- Nashua

- Newport

- Plymouth

- Raymond

- Rochester

- Seabrook

- Somersworth

- Stratford, Groveton (Northumberland), Stark, Odell

Tags: Commissioner Caswell, Gov. Sununu, NH economic development, Opportunity Zones