https://youtu.be/4vL2dWO6YOk

Scribe Software, a company founded in New Hampshire in 1995, was the backdrop this week for the ceremonial signing by Gov. Hassan of two bills reducing taxes for Granite State businesses.

Senate Bill 239, relative to application of the Internal Revenue Code to provisions of the business profits tax, and Senate Bill 342, relative to the sale or exchange of an interest in a business organization under the business profits tax go into effect for the 2017 tax year.

“By simplifying the tax filing process, reducing taxes for New Hampshire businesses, and making it easier for companies to attract capital investments and invest in new equipment, these bipartisan bills will build on those efforts, and I am proud to have signed them into law to reduce taxes for businesses in the Granite State, helping to reaffirm that New Hampshire is a great place for business and our status among the best business tax climates in the country,” Hassan said.

Senate Bill 239 simplifies the tax-filing process for New Hampshire businesses by adopting the most updated federal Internal Revenue Code for the application of the state business profits tax, as well as increases expensing deductions for purchases such as equipment from $25,000 to $100,000. Senate Bill 342 addresses the so-called phantom tax, a measure that the State began working on last year to support growing businesses by changing a unique provision of New Hampshire’s tax code, which will help encourage capital investment and give businesses more flexibility.

“Scribe is honored that the Governor’s office chose Scribe Software’s headquarters as a venue to promote new innovation and business growth in New Hampshire,” said Scribe Software CEO Shawn McGowan. “We appreciate these efforts to make New Hampshire an even better place for innovative businesses to start, grow and succeed.”

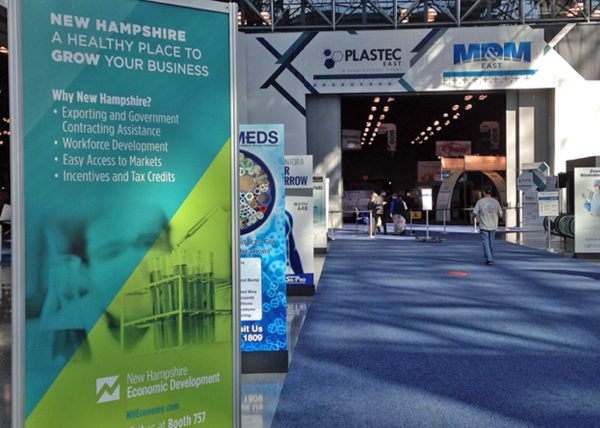

For more information about New Hampshire’s business-friendly climate, including a comprehensive state-to-state comparison, visit www.nheconomy.com/why-new-hampshire/